Are the Next 50 Million Developers Already Here?

Most are coming from India.

Every year GitHub publishes a “State of the Octoverse” report to share insights on the state of open source software and developer ecosystem at large. Every year for the last two years, I’ve written a post to share my own personal thoughts, takeaways, and analysis of the report’s findings.

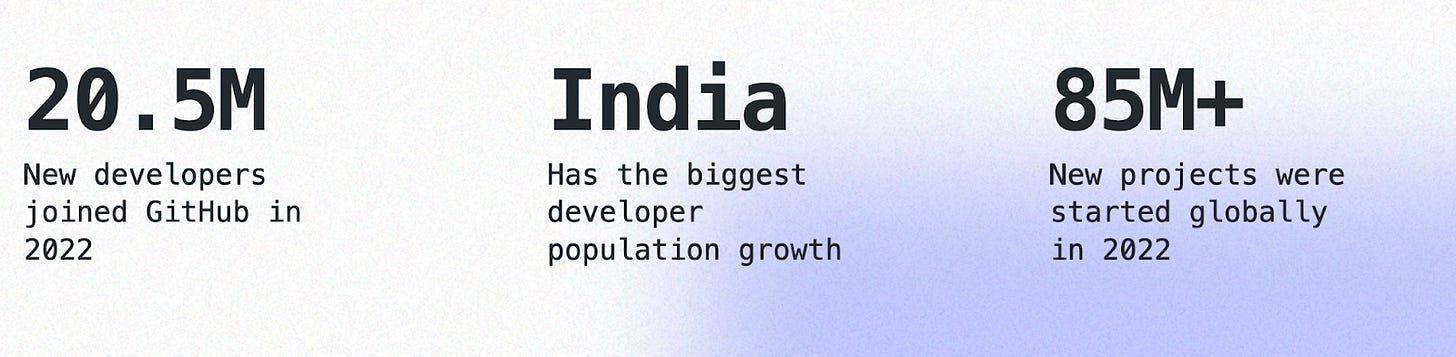

When I wrote about the 2020 edition, GitHub reported having 56 million developers at the time and projected reaching the 100 million milestone by 2025. Back then, I wrote about where these next 50 million developers would come from based on this projection. But just two years later, GitHub reported in this year’s Octoverse report of having 94 million developers on the platform. Looks like the “next 50 million developers” are already here!

Let’s look at some of the revelations from this year’s Octoverse report that I personally find noteworthy and worth pondering about.

(Disclaimer: I have not and do not participate in the research and production of the Octoverse report. The views expressed in this post, and elsewhere on Interconnected, are all personal opinions. They do not represent GitHub, which happens to be my employer at the time of this writing.)

The Rise of India

The most eye-popping revelation and prediction for me is that India had the largest raw number of developer growth over the last year, and if this trend continues, India “will match the current United States GitHub developer population by 2025.”

Open source, as a software development model, has always been a globally distributed phenomenon. Even though the concept took root among the corridors of MIT in the 1980s, the most widely-adopted open source technology to date, Linux, started in the classrooms of the University of Helsinki in Finland. So any country with either a large and/or reasonably educated population can become a leader in open source; it is not supposed to be a US-centric movement. Even in the very first issue of the Octoverse report, published 10 years ago in 2012, GitHub shared that only 28% of its traffic came from the US.

However, there is one often underappreciated element about India in the worldwide tech ecosystem that is uniquely contributing to its rise: global system integrators (GSIs).

GSIs are huge consulting and IT services companies that resell, implement, and deliver services for technology products. It is the “unsexy” part of the industry that enables massive trends (and jargons) like “digital transformation” or “cloud adoption”. These companies don’t come up with new products per se, but they have massive technical workforces, whose job is to learn how to implement whichever product a client wants into its existing systems. Thus, they are called “system integrators”, or SIs.

There is literally an SI for everything. Want to integrate a CRM into your system for your sales team so they don’t use spreadsheets anymore? There are SIs for that. Want to implement HR or accounting software so your back office operations move away from paper documents? There are SIs for that. Want to lift and shift your on-premises IT infrastructure to a public cloud? There are SIs for that. Because the companies that these SIs typically work with are Global 2000 enterprises, their reach and influence is also global. Thus, G + SIs. And the country that supplies the most technical workforce for the top GSIs is India!

Among the top five GSIs:

Accenture

Infosys

Tata Consultancy Services

HCL Technologies

Cognizant

Three are headquartered in India: Infosys. Tata, HCL. For Accenture, ~250,000 out of its roughly 700,000 employees are in India (about 35%). For Cognizant, ~240,000 out of its roughly 330,000 employees are in India (a whopping 72%). This is, of course, not to say that Indian developers only work at GSIs. The country’s growing domestic tech startup ecosystem and large multinational companies setting up engineering hubs in India both continue to be trends as well. But India’s place among all the GSIs is unique.

The second order effect of India dominating the GSIs’ workforce is not only that there will continue to be demand for the country to train more engineers and developers, but that these developers are learning to build, integrate, and provide services for some of the most complex technical challenges facing big companies. This means that Indian developers are higher on the value chain and their skills are more valuable than other IT outsourcing destinations. And as more big companies, both tech and non-tech, use more open source software, they will continue to gravitate towards open source, which shows up in developers growth counts on GitHub, where most of the open source activities in the world take place.

Thus, the rise of India’s developers are both quantitatively and qualitatively noteworthy. And GSIs are the unsung heroes.

IAC and HCL

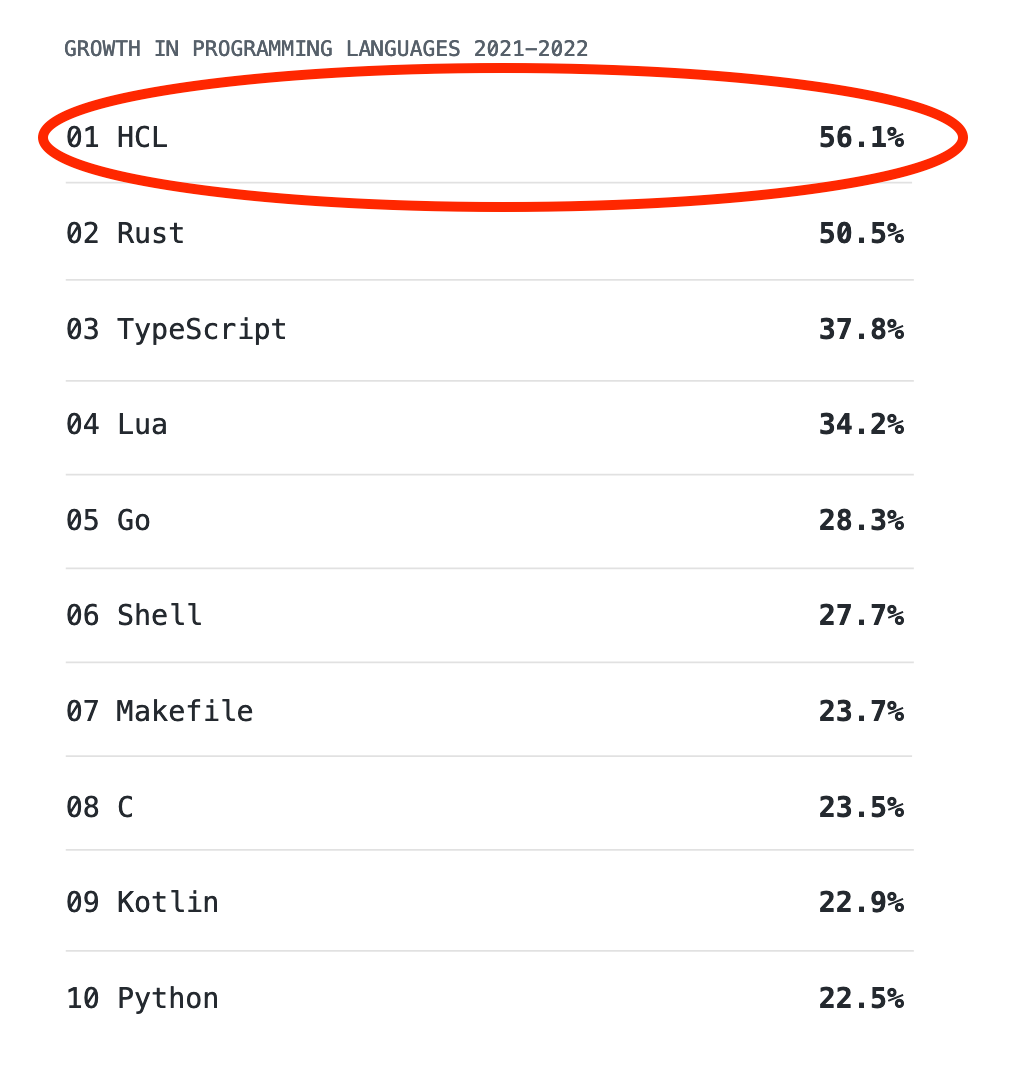

The one technical trend from the 2022 Octoverse report that caught my eye is the increasing popularity of IAC (infrastructure as code) and a new language, HCL (Hashicorp Configuration Language). This trend is neatly aligned with India’s rise fueled by the GSIs.

Here’s why.

Without getting overly technical, IAC is a paradigm that is designed to make provisioning and operating IT infrastructure resources (e.g. servers, virtual machines, containers, databases, etc.) easier, more scalable, and less error-prone for developers. The idea has been around for at least 15 years, so it is not new. But as more IT infrastructure moves to the cloud, as more cloud options become available, and as more services and applications are built on top of different clouds, the “IAC way” is becoming more preferable. That is because IAC is more consistent and templatized, no matter which cloud system you need to work with. That is also what many engineers who work at large GSIs do on a daily basis for their clients. Thus, two seemingly unconnected trends: the increase of IAC’s popularity and the increase of Indian developers working at GSIs, both of which show up in GitHub’s report, are actually two sides of the same coin.

This “coin” is also deeply connected to HCL’s fast growth, which, admittedly, caught me a bit by surprise. Hashicorp is one of the leading companies in the open source IAC space. It is the creator of multiple popular open source projects – Terraform, Vault, Consul, Nomad, Vagrant – all of which address different dimensions of provisioning, operating, and securing IT infrastructure resources on different cloud platforms or on-premise settings. HCL is Hashicorp’s branded IAC configuration tool (the “H”). It initially only worked for Terraform, but has since extended itself to be compatible with other popular formats like JSON that are used often in the IAC context. This interoperability combined with IAC’s popularity likely contributed to HCL’s 50+% growth in the last year.

Calling HCL a “programming language” can be confusing. Unlike more general-purpose programming languages like C, C++ or Go, which you can use to build anything, HCL is a higher-level abstraction that, in its current form, is only used for configuring infrastructure resources – a decidedly more narrow use case. For the same reason, people often question if SQL should be considered a “programming language”, when its use is just for querying relational databases.

I will leave it up to the computer science academics to decide whether HCL qualifies as a “programming language” or not. I find HCL’s growth interesting, because it is very hard for a new, “branded” language of any flavor by a company (in this case Hashicorp) to take off among developers. Many companies have tried, because, if successful, their products will be much stickier among developers, which will boost their long term business prospects. There is a long list of different flavors of SQLs in the database industry – MySQL (relational database of the same name), CQL (the Cassandra NoSQL database), Cypher (graph database from Neo4j), etc. – which have all tried to achieve that developer stickiness to varying degrees of success and failure. It is a tall feat that is rarely achieved at scale. But if this Octoverse report’s findings is a crystal ball into the future, then Hashicorp’s HCL is showing signs of take off.

Even though Hashicorp’s stock price has been dropping like a brick since its IPO last December, Hashicorp’s many open source projects are popular tools among DevOps engineers, system administrators, and the GSIs’, many of whom will be using more HCL in their daily work. The convergence of these trends will eventually accrue value to Hashicorp in the long run. (For readers interested in Hashicorp, see our previous deep dive analysis on its history, products, and prospects.)

Understand (and Invest in) Developers

My long-held industry view and investment thesis is that in an increasingly technology-driven world, developers are the most important people (or persona) to understand, because they are the builders and kingmakers of technology. Reports like GitHub’s State of the Octoverse, Puppet’s State of DevOps, and Stack Overflow’s annual developer survey are all good resources for deepening our understanding of the developer persona.

However, while these reports are routinely consumed by VCs (at least the sharp ones) who invest in the infrastructure software space, public market investors and ETFs still lump companies that target developers or a technical audience with a broad basket of “cloud companies”, just because the end products all happen to be in the cloud. It’s like lumping residential, commercial, and data center REITs all into one ETF, just because they are all built on the physical ground of planet Earth!

Among the top holdings of two of the most popular cloud indices – BVP Nasdaq Emerging Cloud Index and WisdomTree Cloud Computing Fund — you will see companies like Toast (for restaurant), Shopify (for retailers), and MongoDB (a database for app developers) all crammed into one big list. It’s intellectually lazy and downright silly.

One silver lining of an otherwise tough year for both public and private markets is that our understanding may be forced to improve by the reality of the market. True cloud infrastructure software companies, most of which target developers on some level, are starting to separate themselves from the rest of the “cloud bucket”. In Battery Venture’s recent State of OpenCloud report, 8 out of the 10 most valuable software companies are in the cloud infrastructure category, while the other two (Zoominfo and Bill.com) sell to non-technical audiences.

Now that the next 50 million developers are already here, the timing is ripe for a deeper understanding who developers really are and how to invest in them.