($) China’s Provincial GDPs: Pessimism or Sandbagging

I see China delivering 5% GDP growth as a base case.

How well or not well China’s economy will do this year is a monumental question that will affect the entire world’s economy and geopolitical landscape. When Premier Li Qiang revealed to the crowd at Davos that in 2023 China’s economy grew an estimated 5.2%, the market reacted with disappointment.

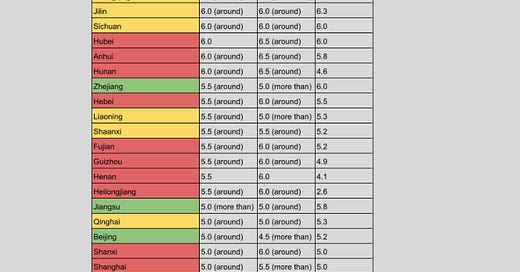

Earlier this month, before the weeklong Lunar New Year holiday break set in, each of China’s 31 provinces, direct-administered cities (i.e. Beijing, Shanghai, Tianjin, Chongqing), and autonomous regions wrapped up their respective 2023 reviews and set 2024 GDP targets. We can garner a lot of useful clues from them.

While there is usually an intense, if not borderline unhealthy, focus and obsession with what the central government does and says, there is a consistent lack of attention paid to the provinces. A country’s economy and GDP for the most part is a sum of its parts. China’s is no different.

What is perhaps unique is the reporting and goal-setting dynamic from the provincial level to the central government level. Almost akin to a OKR system in a tech company setting, how well a province’s GDP does relative to its own target and peer provinces’ performance could either spell a big promotion for that region’s leadership team or a trip to the political wilderness.

Since I have designed and implemented a few OKR systems in my past life as a tech company operator, I thought it would be interesting to give the GDP numbers of these 31 provinces, direct-administered cities, and autonomous regions the “OKR treatment” (John Doerr would be proud) and see what we can learn.

Below is a table of each of these 31 polities’ 2023 GDP target, 2023 actual GDP, and 2024 target. Names in green have delivered 0.3% or more in 2023 versus target, in amber have delivered between +0.3% and -0.3% in 2023 versus target, and in red have delivered below 0.3% in 2023 versus target.