Ford Hearts CATL: America's Awkward Battery Deficiency

Ford, an American national champion, has no choice but to work with CATL, a Chinese national champion -- opting for economic pragmatism instead of geopolitical purism.

Hello subscribers and readers: before we get into today’s post, I would very much appreciate you letting me know if you think this newsletter is worth paying for, by clicking on the “Pledge Your Support” button. Of course, if you don’t think it’s worth paying for, don’t click on it :). I have been writing the Interconnected newsletter, for free, since its inception three years ago. I have a busy day job, so this newsletter is a part-time project for now, but I would like to know if it is, indeed, creating real value and using this button is the best way for me to gauge. Thank you for your help!

Now, on to today’s post:

Deglobalization may be the megatrend of this decade, but it unfolds differently depending on the sector, technology, relative cost, and which country has the most leverage and most friends.

In the US-China context, the United States appears to have more leverage over China in winning the semiconductor manufacturing race, by onshoring TSMC, forming pacts like the “Chip 4” alliance, and applying sanctions to keep China from obtaining choke point technologies, like lithography equipments, to advance its own progress. In 5G, China may be more ahead, but the US at least has alternatives from European companies, without needing to rely on more geopolitically precarious options, like Taiwan.

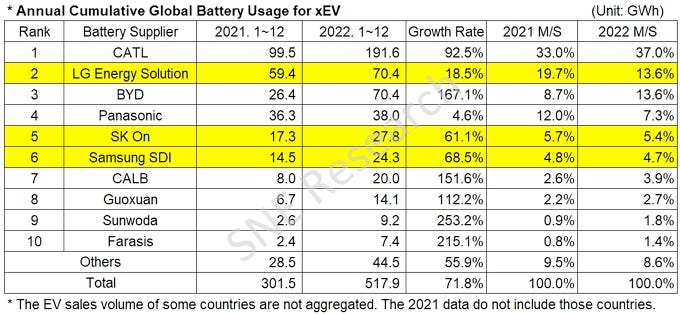

However, when it comes to electric vehicles (EV) adoption in general, and lithium-ion battery making in particular, the US appears to be woefully behind, so much so that American carmakers actually need Chinese technology just to get things started. This vulnerability was made apparent by Ford building its new $3.5 billion battery plant with technology from CATL, who leads the world’s lithium-ion battery production and has almost as much market share as its next four competitors combined. This vulnerability was exacerbated by Ford’s recent suspension of production of its popular F-150 EV pickup truck, due to a fire from batteries supplied by its current partner, SK On of South Korea.

Bad Chemistry

Before we dive into why Ford desperately needs CATL, let’s first look at why SK On has been an insufficient battery supplier so far, even though it is a much safer partner geopolitically speaking.

SK Group, a South Korean chaebol (or family-controlled conglomerate), is a relative newcomer to the EV battery making scene with an outsized ambition to become the world’s largest EV battery supplier by 2030. SK On, its dedicated battery subsidiary, didn’t even exist three years ago, but is now the world’s fifth largest by market share, according to SNE Research.

This turbo-charged growth has been made possible due to SK’s aggressive expansion in the US and tight partnership with Ford in particular. It first built a battery plant in Georgia (mostly to supply Hyundai), then poured $7 billion into constructing gigafactories in Tennessee and Kentucky for Ford. Because of this “pro-America” investment strategy, which will total $52 billion by 2030 across battery making, semiconductor (SK makes a lot of memory chips too), and EV charging systems, SK Group Chairman, Chey Tae-won, was warmly received by the Biden White House and Members of Congress last July.

The problem is SK On bet on the wrong battery chemistry.

A quick primer on the technical tradeoff between different lithium-ion battery chemistries: there are, broadly speaking, two types of batteries for EVs. One type is the lithium-iron-phosphate type, or LFP. The other category includes two subtypes: nickel-cobalt-aluminum (NCA) and nickel-cobalt-manganese (NCM), where nickel and cobalt are the key ingredients. The tradeoff between LFP and NCA/NCM is that LFP has lower energy density than NCA/NCM, but better thermal stability. In more plain language: EVs with LFP batteries have less power, charge faster, but cannot go as far as EVs with NCA/NCM batteries before needing to recharge, while NCA/NCM can go farther per charge but heats up faster (so more likely to cause fire) than LFP. Cobalt is also expensive, so NCA/NCM EVs tend to be pricier than LFP ones.

We know that the battery type SK On has been producing for Ford’s EV F-150 truck is of the NCM variety. So even though its co-CEO, Jee Dong-seob, boasted last year that “I can tell you that you will never see a fire break out in our batteries,” chemistry is still chemistry and its first fire accident is only a matter of time. That time happens to be this month.

To be fair to SK On, choosing NCM was not necessarily the wrong choice when it started three years ago; in fact, it was the popular option at the time, and developing NCA/NCM batteries was what initially propelled CATL to global dominance. And to be fair to Ford, choosing NCM was the right instinct for its EV pickup, because it must produce a truck of comparable power and muscle to its traditional combustion engine option to make it an attractive offering.

Unfortunately, the timing was wrong, as the entire EV market began shifting to LFP, for both cost and safety reasons. To meet this shifting demand, SK On is pivoting hard towards LFP, but even if it meets its own publicly-announced deadline, the first SK On LFP battery won’t appear until 2025. In the meantime, it has no choice but to source LFP batteries from China (probably CATL) to meet its American customers’ demand.

Ford is leaving “$2 billion of profit on the table”, according to its CEO James Farley, due to execution and supply chain issues. Without a reliable battery partner, things will only get worse. Despite the awkward geopolitical implications, Ford, an American national champion, has no choice but to work with CATL, a Chinese national champion – opting for economic pragmatism instead of geopolitical purism.

Not A Trojan Horse

Ford’s “marriage” with CATL was not without its domestic critiques, motivated less by real national security concerns and more by political opportunism. Glenn Youngkin, the Governor of Virginia, proactively took his state out of consideration as the location to build the Ford-CATL battery plant, because he did not want a “Trojan Horse” sent by the Chinese Community Party in his state.

Youngkin is nakedly posturing for a possible presidential bid in 2024 and did not want to miss the “anti-China gravy train”, which I wrote about before. And he is willing to burnish his anti-CCP credentials by grossly misusing a highschool-level Greek mythology reference.

A Trojan Horse is when the sender of the horse wants to infiltrate its recipient for nefarious, destructive reasons. The analogy falls flat on its face, when the recipient is inviting the horse and desperately needs this horse to qualify for some subsidy money.

American EV makers like Ford need the “CATL horse” one way or another, because there is no viable domestic option, while more geopolitically friendly options, like SK On, are not yet up to the task. Even though Youngkin forbade this horse from coming to Virginia, it just ended up in a different part of the United States – Michigan.

In terms of pure unit economics, making EV batteries in the US makes no sense. By SK On’s own admission, LFP batteries made in China cost 20% less than NCM batteries, while those produced in Europe cost 15% less. In the words of its EVP and head of battery division, Jason Lee, “If you produce in the United States, there is no benefit.”

However, if the $7,500 EV tax credit from the Inflation Reduction Act (IRA) is added to the mix, then it could make economic sense. That’s why SK continues to deploy its own technology in factories in the US, in order to help its American customers meet the IRA’s requirements. That’s why the new Michigan-based battery plant is Ford owned, even though underneath the hood, it is all CATL technology. The definition of “Made in America” has been stretched so thin that as long as some of the making happens somewhere in America, it is good enough.

There is no shame in using subsidies to boost demand for new technologies or products. In the context of EV adoption, it is a tried and true strategy, so the IRA’s subsidies are long overdue. EVs have been heavily subsidized in Europe and China, both of which unsurprisingly lead the US in domestic EV penetration many miles (or kilometers). (Chart courtesy of Asian Century Stock’s

)Even though China is leading the world in EV adoption right now, its subsidies will be phased out soon, which is causing concerns in its EV market. Battery makers like CATL, who benefited enormously from its government’s subsidies to juice domestic demand, must look elsewhere to keep growing its business. America, as its own subsidies kick in, is evidently an eager customer.

As

’s incisive critique (though he calls it a “rant”) pointed out, the US is becoming a “Build-Nothing Country.” When we do build something, like an EV battery plant, it is only motivated by subsidy requirements. And to meet those requirements, we now rely on the technologies of a “strategic competitor”, which is benefiting from their own country’s subsidies. It is an awkward reality worth pondering about for everyone who wants to drive a Ford F-150 EV pickup, which I plan to do someday because the truck actually sounds pretty damn cool! (h/t )Despite the seeming inevitability of deglobalization, we still live in a strangely, wonderfully Interconnected world.

You may want to look at

https://electrek.co/2022/04/22/tesla-using-cobalt-free-lfp-batteries-in-half-new-cars-produced/#:~:text=This%20is%20why%20nearly%20half,as%20commercial%20energy%20storage%20applications.

https://www.cnbc.com/2021/10/20/tesla-switching-to-lfp-batteries-in-all-standard-range-cars.html

https://cen.acs.org/energy/energy-storage-/Lithium-iron-phosphate-comes-to-America/101/i4

https://resourceworld.com/lithium-iron-phosphate-batteries-the-next-big-thing-for-electric-vehicles/

I didn't see any mention of the li-ion phosphate plate battery that BYD produces.

They seem to last a lot longer than the standard Li-ion.

Have I missed something ?