How is China’s Cloud Industry Doing?

In a nutshell: still in its early days and mostly stuck in the IaaS stage.

This post was originally published on my standalone newsletter website a few weeks ago. I’m re-publishing it here as part of Interconnected’s launch on Substack this week and to provide context for our first post: How to Invest in China's Cloud. Thank you everyone for subscribing and making our Substack launch successful!

The Chinese economy may well be heading into a recession. But one sector that has continued to grow, seemingly unabated, is its cloud computing industry. According to Canalys, China’s total cloud spending in 2021 increased by 45%, bringing high expectations for more in 2022.

Last month, the China Academy of Information and Communications Technology (CAICT) published an in-depth, 47-page-long whitepaper, analyzing the current state of the country’s cloud industry. The CAICT is a think tank affiliated with the Ministry of Industry and Information Technology (MIIT) – a key regulator of China’s tech sector and a Ministry of frequent discussion in my previous writings (see tags: open source and e-CNY for more on MIIT). This is the 8th such whitepaper the CAICT has produced; the first one was published in 2012.

You can think of this whitepaper as the most official assessment of how China thinks its own cloud industry is doing, not what an outside industry analyst firm, like Canalys or Gartner, thinks in order to serve their clients, e.g. institutional investors and money managers.

So how is China’s cloud industry doing, according to China? In a nutshell: still in its early days and mostly stuck in the IaaS stage.

Let’s unpack this whitepaper for more details and nuances.

Cloud Maturity: China Versus the World

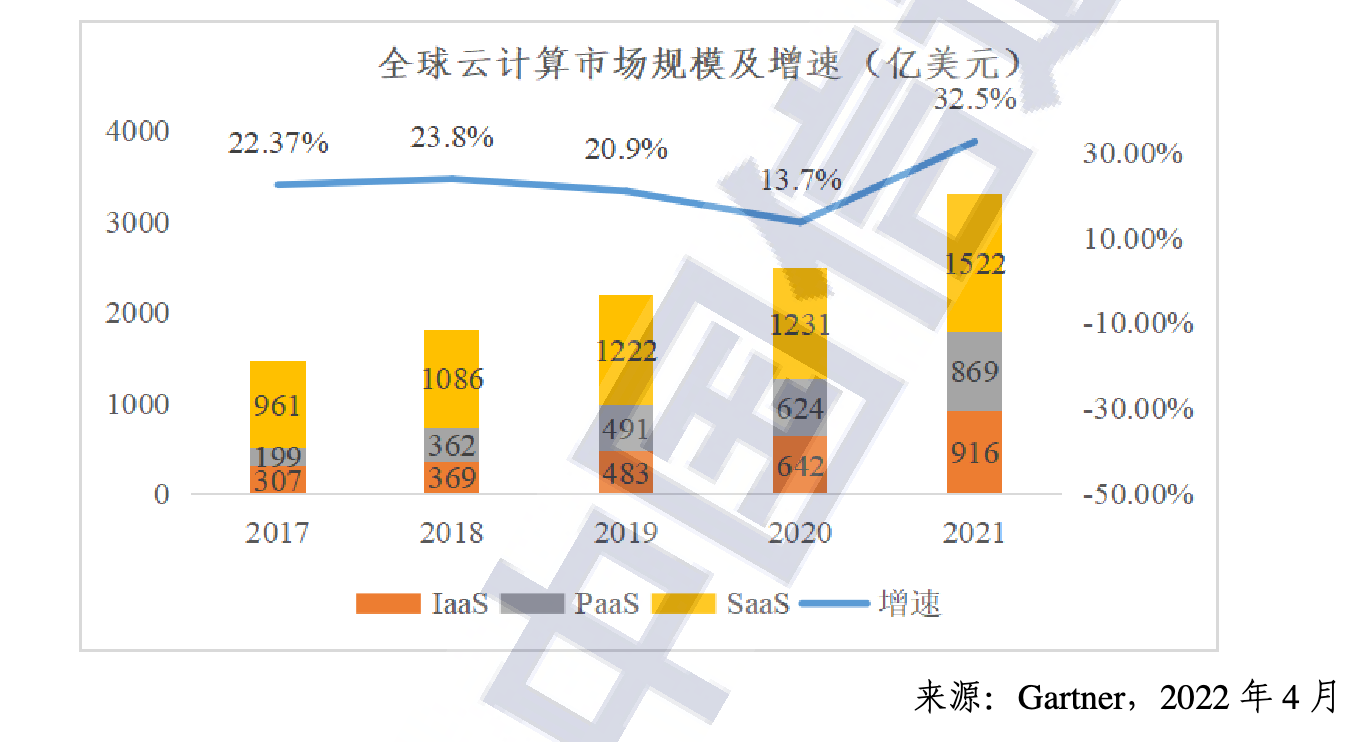

The whitepaper began by citing Gartner’s global cloud computing growth trajectory (see graph below). This shows that even an official Chinese think tank relies on Gartner as a main source of information to an extent. (Well done, Gartner!) Interestingly, the whitepaper separates the cloud market into three buckets – IaaS, PaaS, and SaaS – to illustrate some significant differences between China’s cloud industry growth characteristics and the world’s.

An aside on terminology, a full-fledged cloud computing service is generally broken down into three layers:

IaaS (Infrastructure-as-a-service, aka processors like CPUs/GPUs, storage units like SSDs or hard drives, and networking bandwidth for rent)

PaaS (Platform-as-a-service, aka database, application development, big data analytics engine, AI/ML frameworks for rent)

SaaS (Software-as-a-service, aka user-facing applications like email, workplace messaging, video-conferencing, document-sharing for rent)

In Gartner’s global projection, while all three layers of the cloud are steadily growing, SaaS makes up the largest proportion, while IaaS and PaaS almost equally split the rest of the market. The picture is starkly different in China.

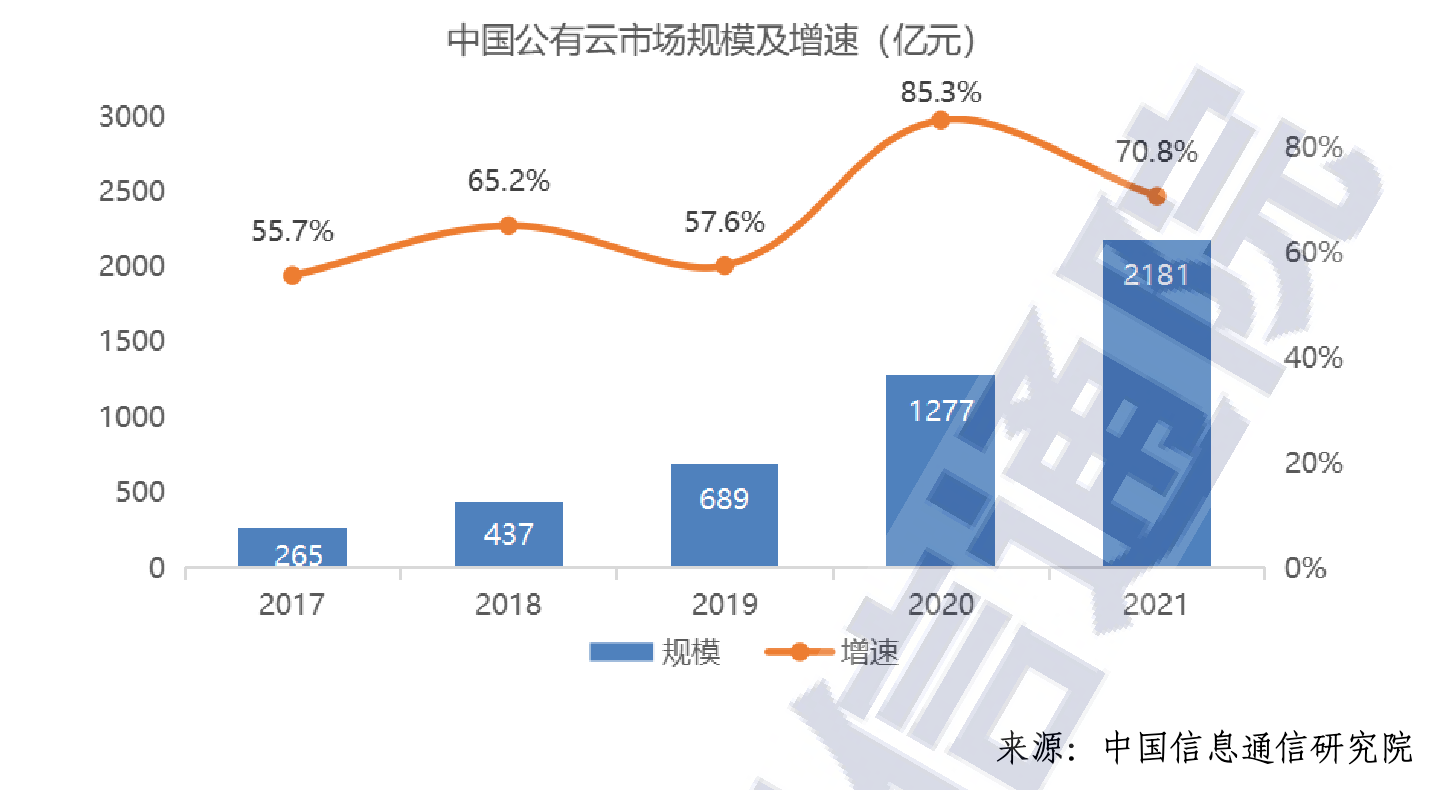

Based on CAICT’s own data (see graph below), IaaS (in blue) makes up almost three-fourth of China’s entire cloud and is growing rapidly (67.4%, 97.8%, 80.4% respectively in the last three years). SaaS (in yellow), on the other hand, is the second largest but markedly smaller with a much lower growth rate compared to IaaS (34.2%, 43.1%, 32.9% respectively in the last three years). PaaS (in gray), which architecturally sits between IaaS and SaaS, is the smallest of the three buckets, making up only 10% of the whole cloud computing pie. That being said, PaaS’s growth rate is higher than IaaS, albeit on a much smaller base.

What does this mean?

China’s cloud journey or “digital transformation” (to use the industry buzzword) is still in its infancy. Adopting IaaS (from owning your own machines and networking equipment to renting from a cloud vendor) is the first step for any large enterprise’s migration to the cloud. It is clear that most of China’s cloud spending growth is still happening at this layer, and will need some time to mature before spending moves to the PaaS and SaaS layer.

Public versus Private:

This whitepaper also provides a useful breakdown of the relative adoption size and rate between public and private clouds. In short, China’s public cloud is about twice as large as its private cloud (218.1 billion RMB vs 104.8 billion RMB) and is also growing twice as fast (70.8% vs 28.7%)! (See graph below, first one is private cloud, second one is public cloud.)

This data contradicts a common perception in the market that the demand for public cloud in China is declining – a conclusion drawn from AliCloud and Tencent Cloud’s slowing growth rate. However, China’s cloud market, both public and private, is much more crowded and competitive than the duopoly of Alibaba and Tencent.

Which Cloud Vendor is Winning?

Based on CAICT’s numbers, the top five public cloud IaaS providers by market share in 2021 are:

AliCloud: 34.3%

CTyun: 14% (China Telecom’s cloud)

Tencent Cloud: 11.2%

Huawei Cloud: 10%

Mobile Cloud: 8.4% (China Mobile’s cloud)

Although AliCloud remains the leading provider by a healthy margin, state-owned telcos like China Telecom and China Mobile are becoming formidable players in the fast-growing IaaS layer. Telcos entering the cloud market is quite common in many markets. They are typically the default Internet Service Providers (ISPs) and mobile data providers of a country, with the foundational infrastructure and networking capacities already in place. Becoming a cloud IaaS vendor is a matter of converting their existing resources to a “for rent” model. (In fact, it is a bit surprising that AT&T and Verizon are not bigger players in the US cloud market.)

What’s also noteworthy is the increasingly even distribution of market shares. It was only a few years ago when AliCloud was more than 50%, and its aggressive marketing department would gloat about being bigger than the next ten competitors combined. Not any more!

The public cloud PaaS market share leaders, in CAICT’s eyes, are the following:

AliCloud

Huawei Cloud

Tencent Cloud

Baidu Cloud

Naming these vendors as leaders is not surprising, because building attractive PaaS solutions requires attracting more capable tech talent, which pure tech giants like Alibaba and Huawei are better positioned to do than SOEs, like China Telecom. It takes more than just converting existing infrastructure to a different, for-rent business model to compete in PaaS.

However, the whitepaper does not provide a proportional breakdown for the PaaS layer, and did not even mention the SaaS layer. That’s likely because these two segments are simply too small and immature in the grand scheme of things, as we already illustrated.

Three Tiers of Maturity

While China’s overall migration to the cloud is progressing quickly, the progress is not evenly distributed. The CAICT provides its evaluation of which industries are ahead and which industries are lagging behind, separated into three tiers.

Tier-1: Internet and IT services sector. Unsurprisingly, these two sectors are the most tech-native and tech-forward of all the sectors. In CAICT’s assessment, their cloud journey is quite mature, having already integrated advanced technologies in AI, big data, and even blockchain to the use of best-in-class cloud technologies. They are the leaders of the pack.

Tier-2: Financial services, government, and transportation sector. This tier-2 can be roughly understood as sectors that are not on the bleeding-edge per se, but are mature enough in their cloud migration to be comfortably adopting technologies and architectures, like containerization, microservices, and middlewares in their core systems. Successfully adopting these types of technologies is a good indicator of becoming more “cloud native”. Having the financial sector in this category is not surprising, given that banks and financial institutions tend to be early adopters compared to large enterprises in other sectors. This is especially true in China, where the advancement of fintech and neobanks is fast and pose serious competition. What did surprise me is having both government and transportation – two common late adopters of technology – included in this tier-2. If the government sector’s receptiveness to the cloud is indeed on the same level as financial services, then the rise of “govcloud” as a product line could be a key driver of growth for China’s cloud industry in the next few years.

Tier-3: Energy, healthcare, and industrial sector. This tier-3 encompasses sectors that are still “nibbling around the edges” when it comes to cloud. For the energy sector, in particular, cloud adoption is literally limited to the edge – small workloads in far-flung remote regions, not at the corporate headquarters or where its core systems are managed. The CAICT whitepaper gently called out these sectors as laggards, whose progress to “cloudify” their core systems has much room to improve.

Buzzword Cloud

Even though it was written by a government think tank, there is no shortage of industry buzzwords in this whitepaper. Here is a list of my favorite buzzwords and their frequency of appearance:

Microservices: 10

Open Source: 8

Chaos Engineering: 4

DevOps: 3

Serverless: 3

Because this CAICT whitepaper does not share any information on its research process, it is difficult to verify the source and reliability of its data and commentaries. However, the whitepaper reads mostly like what you would expect from any think tank or a group of government technocrats – dry, to the point, appropriately boring. It also pinpoints many weaknesses in China’s cloud industry, especially in areas like cybersecurity and software supply chain, and is not a full-throated celebration of the industry's growth.

While we should always treat government publication with a grain of salt, this one’s purpose seems mostly to inform without any ulterior agenda.

p.s. the bilingual (English/Chinese) version of this post is published on interconnected.blog