The IPO market has been frozen not just on Wall Street, but around the world, especially for new, emerging companies. So much so that the only IPO that has been grabbing attention is Volkswagen’s spin-out IPO of Porsche – a 70-plus-year-old brand – on the Frankfurt Stock Exchange.

Two recent listings show that the IPO window on the Hong Kong Stock Exchange (HKEX) may be opening up. One is CALB (3931.HK), a fast-growing lithium-ion battery producer. The other is Star Plus Legend, a holding company that contains all the songs, movies, IPs, and other businesses of the Taiwanese music mogul, Jay Chou.

Two very different companies that, together, may signal the appetite for new listings on the HKEX has returned.

CALB

CALB’s IPO is the largest on the HKEX this year, netting the company a healthy proceeds of around $10 billion HKD (roughly $1.27 billion USD). It is also the HKEX’s first listing representing the lithium-ion battery sector that’s fueling the electric vehicle (EV) industry.

Most people who follow the EV market may be familiar with CATL, the dominant Chinese battery maker that supplies Tesla, Honda, Volkswagen and many other carmakers, or the Warren Buffett-owned BYD.

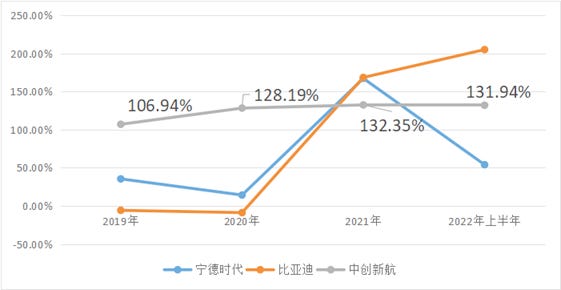

CALB, on the other hand, is an upstart that has struggled in its early days, survived the so-called “new energy winter” in China (2017-2018) with a corporate turnaround, and is now striving. Its battery installation base has grown more than 100% in each of the last three years – an unprecedented growth rate in this industry, albeit on a small base.

CATL is still the market leader by a wide margin. However, a smaller, faster-growing rival like CALB can become a serious challenger, if the capital market is robust and optimistic enough to pour money into tech IPOs. This is especially true for lithium-ion battery production, where large capital expenditure is needed to acquire mines for raw materials and build plants to produce the batteries. The capital market’s attitude has been cold this year as the world wrestles with war, rising interest rates to tamp down inflation, and, for China specifically, a struggling economy in the face of “dynamic zero-COVID'' compliance.

Now that CALB has taken the plunge on the HKEX and added more than a $1 billion USD in the bank to fuel its future growth, there is reason to believe that the attitude of the capital market, at least in Hong Kong, is warming up to more technology ventures. It is a bit too early to say how “warm” though. CALB’s IPO was priced at the low end of its range ($38 HKD) and price has been falling during its first few days of trading.

That’s why I’m paying attention to how Jay Chou’s company will fare when it starts trading on the HKEX.

Jay Chou

Dubbed the “King of Mandopop”, Jay Chou has been ubiquitous in the Chinese entertainment industry for the last two decades. (He has also tried to break into Hollywood with movies like “The Green Hornet” without much success.) Even though pop stars are rarely the focus of this newsletter, Chou’s business empire and tech-savviness more than deserves a few paragraphs.

Beyond songs and movies, both of which he produces prolifically, Chou also has his own record company (JVR Music), reality TV show (J-Style Trip, available on Netflix), coffee brand, skin-care product, and Phanta Bear – a NFT collection he launched with his wife on OpenSea that sold out in 48 minutes. All of this “stuff” and more are part of Star Plus Legend, the holding company that filed for its HKEX IPO, coincidentally, one day before CALB started trading.

It is as if Jay-Z, the American hip-hop mogul, put all his songs, Roc Nation (his record company), Tidal (his music streaming app), clothing lines, and various other businesses into a holding company – and listed it on the NASDAQ.

(Both “Jay’s” embody one of Jay-Z’s most famous lines in the song “Diamonds From Sierra Leone” – "I'm not a businessman, I'm a business, man.")

Jay Chou’s road to an IPO was not all smooth. Star Plus Legend filed for IPO twice before in September 2021 and March 2022, but did not go through with the listing, likely due to tough market conditions. Whether this third time will be a charm for Chou remains to be seen, making this filing all the more worth watching.

A “pop star IPO” is the perfect “catnip” for retail investors, who have been leaving the market in droves due to the massive downturn this year. While there will certainly (hopefully) be serious stock analysts breaking down Star Plus Legend’s financial statements and future prospects as a media tech company, many “mom-and-pop” investors would want to buy the stock just to own “a piece of Jay Chou”. What they need is a little bit of cash and “yolo” optimism – the same optimism that may fuel the next CALB-like tech company to go public.

If Jay Chou and CALB can generate enough optimism on the HKEX, the frozen IPO window may indeed be thawing in the Asia-Pacific. And if that happens, the question everyone will be asking is: will Wall Street be next?

p.s. the bilingual (English/Chinese) version of this post is published on interconnected.blog