To be a competent investor, one of the most important attributes is to see the world accurately and rationally, and not get too carried away with one’s wishful thinking, however idealistic and aspirational that might be.

We are now a few days removed from some major events – the US Election, the Federal Reserve meeting, and China’s National People’s Congress Standing Committee gathering. (It was a busy week!) It is as good a time as any to update my own thinking on what is accurate about the US and about China.

When I published my Q3 2024 investing performance a few days before Election Day, I shared my base case leading into the event, which is that we won’t know who the next US president will be for quite some time. I was wrong. The final result was quick and decisive.

Voting is an exercise to express what one wants the world to be. Now that voting is done, it is time to see the world accurately for what it is.

Trump’s Obama-esque Victory

There are a lot of similarities between Trump’s victory this time and Obama’s in 2008.

Both men leaned into their “no war” credential at a time when the US has been, directly or indirectly, involved in foreign conflicts. Obama amplified his opposition to the Iraq War as a state senator in 2003 – a key differentiator that helped him defeat Hillary Clinton in the primary and became a perfect vessel of rebuke to George W. Bush’s wars. Trump played up his first term as the only time when the US did not engage in more foreign conflicts, while pulling out of Afghanistan, as a rebuke to the US engagement in Ukraine and, to a lesser extent, the Israel-Hamas war.

Both men also leaned into the country’s economic distress to become the candidate that people trusted more to fix the economy, even though the real economic conditions between 2008 and 2024 could not be more different. The Great Financial Crisis reached its crescendo at the most critical moment of the 2008 campaign. It was a terrible event that still has far reaching consequences (more on that later when we talk about China). While John McCain proclaimed that the “economy was doing fine”, laid off bank tellers from Wachovia and Bank of America flowed into my campaign office in Charlotte, North Carolina, to volunteer for Obama. Today, inflation is under control, the economy is growing, the country is at full employment, and the stock market is soaring, yet there is enough inequality and unclear economic prospects in people’s minds that made Trump the preferred candidate for the economy. (Stoking fear about rampant illegal immigration also “helps” in making people believe that they are in economic distress.)

A hard truth worth remembering: people are always more motivated to vote on bread and butter issues (it’s the economy stupid!), not so much on intellectual concepts (democracy vs autocracy). Whether the economy is actually doing poorly or not, and whether democracy is actually being undermined or not, is an entirely different matter.

Even on a campaign tactical level, there are similarities. In this election cycle, the Republicans made a big priority out of registering new voters and pushing them to do early voting. This is an almost carbon copy tactic of what the Obama campaign did in 2008. This expansion of the electorate in one team’s favor, oftentimes at the expense of the other, also assembled a diverse group of voters that challenged all the assumptions of identity politics. Thus, leading up to Election Day, all the reported numbers of Republicans leading Democrats in early voting felt like deja vu for me. When all the results rolled in, Trump’s growing support across all minority groups also felt similar to Obama’s 2008 coalition, though the degree of Trumps’ appeal took me by surprise initially. Of course, as a minority immigrant turned naturalized citizen, I shouldn’t have been too surprised.

Another hard truth worth remembering: very few people want to be the first X to do Y. Most people want to be recognized as good at doing Y, who just happen to be X. No one likes to be a token. Also, the one group that detest illegal immigrants the most are legal immigrants.

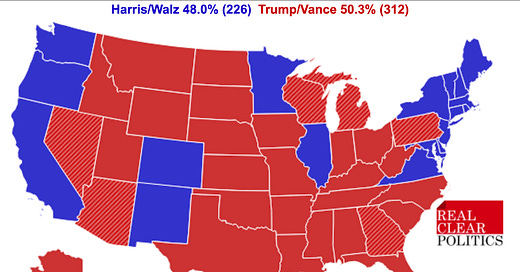

In the end, the electoral map played out similarly. Obama swept all the swing states in 2008 and some, ending up with 365 electoral votes. Trump also swept all the swing states this time, ending up with 312 electoral votes. Both victories would be considered a “landslide” by modern standards with the winner receiving a “mandate” from the people.

This Obama 2008 and Trump 2024 comparison is in no way meant to suggest that the two men are similar as people or as presidents. The two could not be more different in those regards. But it's worth being honest (and accurate) about the surprising, even uncomfortable, similarities between the nature of the electoral victories that both achieved.

Institutional Resistance

The most important difference between Obama and Trump, from a governing perspective, is that the former respects and wants to strengthen existing institutions (he was a constitutional law professor after all), while the latter reviles and wants to dismantle as many institutions as he can get his hands on.

We got an early and accurate look of what this looks like from the Federal Reserve press conference that took place two days after Election Day. While the 25 basis points interest rate cut was entirely expected and not newsworthy, Jerome Powell made news when he was asked twice what he would do if Trump tried to fire him or any of the other Federal Reserve governors. His answer was a curt but emphatic “No” and that such an act is “not permitted under the law”.

Interestingly, Powell’s own career on the Fed neatly threads the dichotomy between Obama and Trump. A classic institutionalist, he was nominated by Obama in 2011 to be one of the Federal Reserve governors. He was then elevated to be the Fed Chair during Trump’s first term.

Throughout the 2024 campaign, Trump signaled his desire to interfere with the Federal Reserve’s political independence, if he becomes president again. Now that he will indeed be president again, the #EndTheFed movement, boosted by his biggest booster, Elon Musk, is picking up steam.

One important difference between Trump 1.0 and 2.0 that needs to be accurately accounted for is that Trump 1.0 was not prepared to win, clueless about how the levers of government worked, thus had to bring on institutionalists to boost his credibility and show him how to wield power. Most of those institutionalists tried to thwart his instinct to undermine institutions from the inside and became his biggest detractors over time. Trump 2.0 is entirely different, having done the job once and knowing the limits and boundaries already. Plus, he has control of the Senate, and most likely the House as well.

Thus, over-analyzing Trump 1.0 to predict what Trump 2.0 will look like will lead to lots of wishful thinking. Whatever Trump 2.0 intends to do, people should take it both seriously and literally and add a new dose of “competence” to the mix. This starts with the Fed.

The Fed’s independence is not something to be taken for granted and has always endured plenty of political interference over the years. The George H.W. Bush White House tried hard to get Alan Greenspan, the Fed Chair then, to make looser monetary policies after the 1987 market crash to make the economy look better. When Bush lost his reelection campaign to Bill Clinton, who pioneered the “it’s the economy stupid!” campaign message, Bush blamed Greenspan's resistance as one of the key reasons for his loss.

The Trump vs Powell fight will just be one of many examples of “institutional resistance” to play out in the next four years, as a more “competent” Trump 2.0 wields its power to challenge the boundaries of legality and institutional integrity.

Meanwhile China Does China

Tying a bow to the end of an eventful week was China concluding its National People’s Congress Standing Committee meeting and announcing new fiscal measures to alleviate local governments’ debt woes.

This was one of the most anticipated NPC meetings in recent memory, due to high expectations of fiscal stimulus and its curious timing for overlapping with the US election. Rumors and hottakes ran rampant, mostly in western financial media, on whether Chinese policymakers would adjust the size and nature of fiscal support on the fly, depending on who wins the US election.

These rumors felt silly and borderline preposterous to me, because so much of China’s economic problems are domestic. Whatever the NPC passes should be China trying to fix China. However, it is impossible to rule out whether extraordinary outside events would warrant extra-procedural measures. After all, to many people around the world, Trump 2.0 is still quite extraordinary. To assess how event-driven are Chinese policymakers to US political developments, I had to set up a small test: if the NPC announcement has a headline number that is larger than 10 trillion yuan (the highest rumored number heading into the legislative session), than an “audible” was likely called at the NPC to do more because of Trump’s victory.

The headline number turned out to be 10 trillion, or 6 trillion, or 12 trillion, depending on how you add things up. Labeling the measures as “stimulus” is also debatable, especially if you come from a primarily western orientation of the term. The package was all focused on lessening local government debt burdens through different debt swap programs, with the (theoretical) effect that funds that would’ve gone to paying down debt would be freed up to spend on high-tech investments, social programs, and other welfare measures to “stimulate” normal people’s economic activities. It is an indirect stimulus at best.

Regardless of what the headline number should be or the proper semantic of the word “stimulus”, the rumor (or hopium) that China would adjust how it fixes its economy depending on what happens in the US is invalidated. This conclusion may seem obvious to some people, but I needed a test to evaluate it, in order to see the world accurately.

What’s more, any form of direct stimulus – giving consumers money to spend, buying up toxic property, injecting liquidity into the stock market – is seen as measures of last, not first, resort in China’s hierarchy of policy preference. It is, in many ways, the polar opposite of the US. Despite a persistent chorus of mostly western financial media and investors pushing China to stimulate its economy like the US, and vote with their dollars by selling every time they are disappointed, another hard truth is worth remembering: China will continue to China.

This divergence between the US and China on how to run a big, complex economy was not at all guaranteed. In fact, all trends were leading to closer convergence until the Global Financial Crisis. As Ben Rhodes, former deputy national security advisor for Obama, reflected in his post-mortem Op-Ed on the 2024 election, the GFC was when liberalism started to lose its appeal. That was when China started to wonder whether following the US economic model, its intention at the time, was still a good idea?

China wasn’t alone. Many western countries wondered the same. What emerged was sixteen years of shifting towards more nativism, nationalism, and state capitalism to varying degrees across the world. Biden’s America was the last to succumb to this mega shift, with its own industrial policy programs, supply chain decoupling from China, and economic protectionism, only to fall to Trump.

Thinking back, I was in a messy campaign office when Lehman Brothers fell and the only tangible impact on me was better volunteer recruitment, as I breathed the air of hope and change. Little did I know then that the GFC would be the trigger point of so many global tectonic shifts which I’m still wrestling with today. As Rhodes wrote, eight years of Obama was not the start of a new wave of idealism, but “swimming upstream” against a global wave away from idealism.

It’s always important to not lose one’s ideals and aspirations in the face of challenging realities. After all, any meaningful human progress started with not accepting the status quo. But not seeing the world accurately can also lead to painful and costly mistakes, especially if your day job is investing professionally.

The line between idealism and delusion is thin. So is the line between accuracy and cynicism. The right place, as always, is somewhere in between.

This was a great analysis. Thanks Kevin.

Thank you Kevin for elegantly written, sharply delineated analysis. I appreciate the way you draw in your autobiographical circumstances, provide high order semantic analyses that inspect oft taken for granted ideologicaland philophical positions. I know, quite a mouthful from me.