Software Is Not Dead

But AI is killing “land and expand”

When I started working in the enterprise software industry almost a decade ago, the most effective (and thus fashionable) go-to-market (GTM) strategy was bottoms-up “land and expand.” Some of the poster children back then of executing this model to extraordinary success were Slack and MongoDB. Everyone wanted to be Slack or Mongo.

I was lucky enough to have entered the industry at a relatively high level – reporting directly to the C-suite in all my roles. Because my roles were all multi-functional, in charge of designing and executing GTM motions while budgeting and buying different software solutions to help accelerate those motions, I had an intimate feel of the “land and expand” GTM strategy from both sides of the table. I was in the trenches, as a seller and a buyer.

It is through this operator’s lens that I have been processing the many thought pieces being published on why software is dead, in reaction to the recent steep drops in share prices of various public cloud software companies, e.g. Snowflake, MongoDB, UiPath, Sentinel, and Salesforce, which of course bought Slack.

Contrary to the chorus, software is not dead. If anything, generative AI is still a software play at its core, even though most of the expenditure is on the hardware side right now to enable it. But through some reflections of my own experiences, how sales and procurement works in general, and how AI has quickly become “strategic” to every large enterprise, it’s quite clear that AI is not a blessing, but a curse to the “land and expand” gospel. This is a structural shift in the market that necessitates a re-architecting of many software companies’ internal workings.

Companies that can re-architect and attract the right talent quickly will survive (and thrive). Companies that have some history or DNA in executing top-down sales motion, but got pulled “down” by the trendiness of “land and expand” will adapt quicker. The rest will be taken off the playing field.

Let’s unpack all this in more detail.

AI Strategy is a Corporate Political Honeypot

First, let’s talk about why “land and expand” worked so well, before we discuss why today’s AI is anathema to this model.

When companies like Slack or MongoDB were flying high via their bottoms-up GTM, the main reason why that worked so well was because their solutions were delightful but not strategic.

Slack was a delightful workplace chat product that initially gained a foothold among engineering teams, who were sick of toggling between email and Jira issues all day. With a nice freemium offering and easy deployment that did not touch any sensitive parts of an organization, a director-level engineering manager could just use a corporate credit card to buy some Slack seats to make his engineers happy. He may or may not have told his boss that he did this. Either way, his boss, likely a senior director or VP-level person, would not care as long as the purchase was not too expensive, because no one got promoted for adopting Slack. It was not strategic.

As time went on, more and more teams started paying for Slack in the same way. The first “land” started to “expand”, and soon enough the C-suite, most likely the CIO, took notice. Since the product was delightful but not strategic, the CIO did not want to stand in the way of more adoption, but did need to exert some oversight to enforce compliance and good corporate hygiene. So he put Slack through a more rigorous procurement and compliance process, it passed, and the company went wall-to-wall with Slack. The CIO likely did not get a big raise or bonus from the CEO, but he probably got a lot of sparkling hearts emojis 💖 from employees…in Slack.

MongoDB’s “land and expand” worked in a similar fashion, even though its product is very different from Slack and arguably has a bit more strategic value. As an open source NoSQL document database to start, it was free and easy to try out MongoDB to build an application. After the company rolled out its cloud-native offering, called Atlas, “easy” became even easier. An engineer team lead or manager can, again, just use his corporate credit card to provision a cluster of MongoDB in whichever cloud platform his team likes, without needing a heavy-handed approval process from the top. Of course, a database by definition stores data, oftentimes customer or user data, so letting a database spread like wildfire willy-nilly without oversight is not a good idea. The CIO and CTO start to get involved, though neither is rewarded for being a stickler about choosing MongoDB versus AWS DocumentDB versus Azure CosmosDB. It is an important decision, but by no means a strategic one for other executives in the C-suite. Also, remember, this was a few years when money was free. Since the company’s developers already loved MongoDB (for whatever reason), the “land” eventually expanded successfully.

There are many other similar examples. Slack and Mongo are not the only ones, though they were the most well-known. Back when I was working more closely with startups, everyone wanted to figure out what their version of a Slack or Mongo “playbook” is.

Fast forward to today, AI has flipped the script on that playbook.

The key reason the script got flipped is because AI is seen as “strategic” internally by every executive. Thus, everyone in the C-suite – CEO, CFO, COO, CTO, CPO, CIO, CISO, CRO, CMO, CHRO, General Counsel (did I miss anyone?) – as well as their respective lieutenant EVPs and VPs want to be involved in any technology that is even marginally related to AI. Being left out will create a lot of resentment, insecurity, and corporate battles. On the other hand, involving (literally) everyone will lengthen the adoption timeline of any AI-related technology, with many more cooks in the kitchen. Ultimately, AI is a political honeypot for corporate leaders, because everyone wants to be known as playing a “meaningful role” in this generational technology platform shift.

The political nature of enterprise technology adoption is not new. Mark Cranney of Opsware and a16z fame called out back in 2014 that selling technology to an enterprise is a lot like passing a bill in Congress. For a while, “land and expand” was able to get around this dynamic with delightful products plus a freemium teaser, helped ironically by a lack of strategic value in the beginning. With AI, the “political-ness” of selling software into large companies has only intensified. Everything that touches AI is an “enterprise contract” by default; no more swiping corporate credit cards without top-level approval.

Many software companies are caught between a rock and a hard place. If you don’t sing the AI tune, you will be tossed into the dustbin of irrelevance by investors. But if you sing the tune too loudly, without the necessary top-down enterprise relationships or sales and post-sales teams to support (likely because you were organizationally architected for a bottoms-up motion), then you will be ill-prepared to navigate the internal politics of a would-be buyer.

A longer sales cycle was the most common reason for disappointment on the earnings calls of companies that took a beating during the “software bloodbath.” If even firms with a history of strong, top-down enterprise relationships, like Salesforce, are subjected to this reality, it’s no surprise that companies with a more bottoms-up DNA, like MongoDB, are feeling the pain.

Early Indicators, Early Casualties

There are, of course, other valid reasons that are contributing to the woes of software companies, beyond the corporate political dynamic among the CXOs of prospective buyers.

For one, the overall enterprise budget is still tight, and any spending on an AI initiative is more likely taken from another part of the IT budget, not new dollars allocated. Many internal efforts to consolidate software vendors continue apace. A higher for longer interest rate environment, re-confirmed by yesterday’s June Federal Reserve meeting outcome, also means large enterprises will be less willing to part ways with cash for AI, when their corporate coffer can earn a healthy interest income, until the AI solutions are more proven. I’ve written about this connection between higher interest rate and pace of IT spending last December, when there was already evidence that companies prefer shorter term contracts, to preserve more optionality with their cash vis-a-vis spending pace.

All this is not to suggest that AI is not real, not useful or not generating meaningful revenue. OpenAI’s recent leak of doubling its ARR since late last year to now an impressive $3.4 billion is the latest proof point. However, OpenAI has the backing of arguably the one company that has the deepest enterprise relationships, Microsoft. Without the giant at Redmond, OpenAI’s revenue would be a fraction of what it is making today.

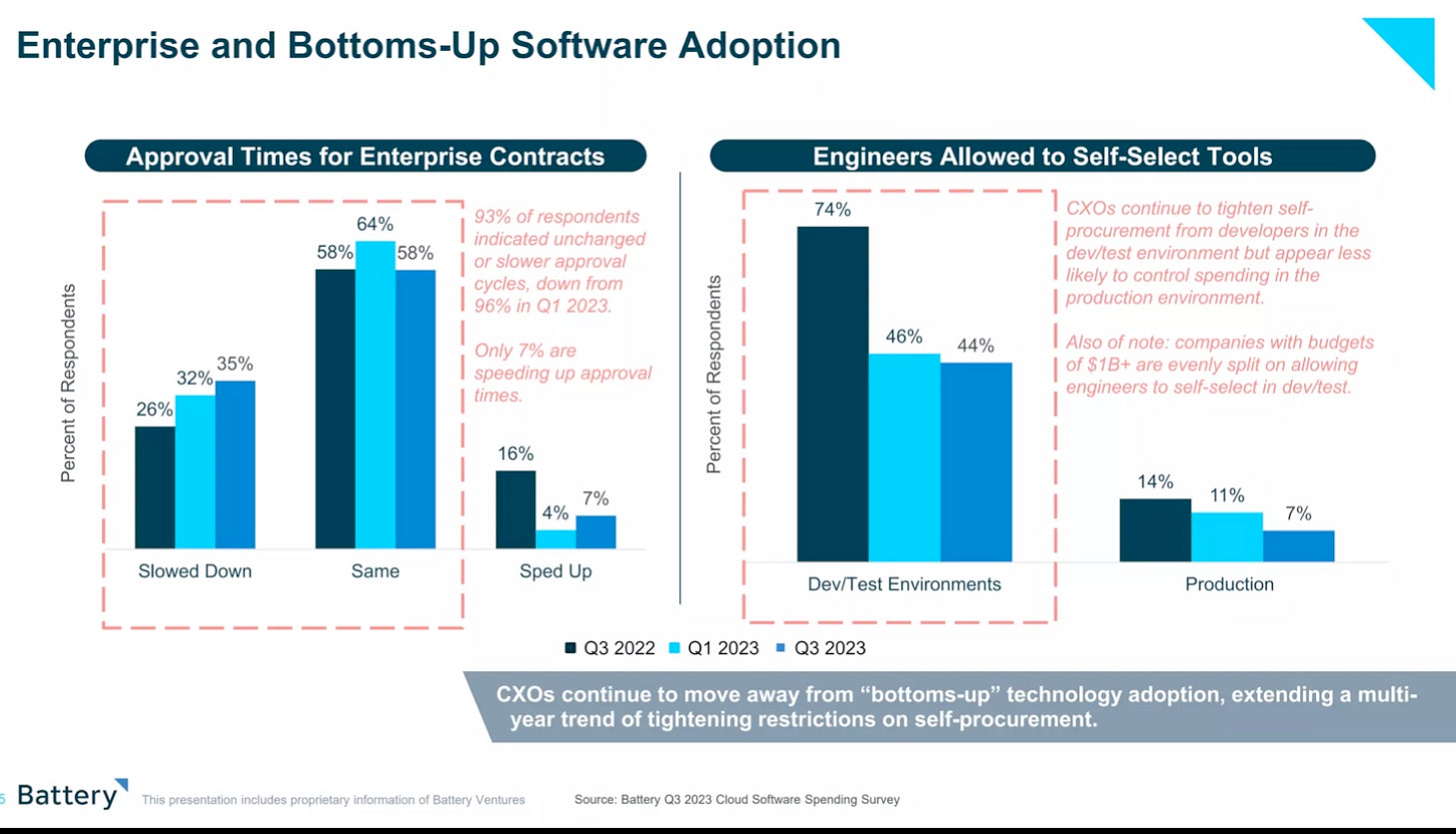

The “software bloodbath” may have caught many by surprise, but there were some early indicators. In the survey results of Battery Ventures’s “State of Enterprise Spending” published report last September (so covering sentiments up to Q3 of 2023), approval time for enterprise contracting was already getting longer. Budgets were getting reduced, while the practice of “self-procurement” that’s so crucial to the “land” part of “land and expand” continued to get restricted.

Here are two of the most telling slides from the report:

There have also been some “early casualties” in the public market as a result of this phenomenon. The most notable one being IBM’s acquisition of Hashicorp, a multicloud developer tool automation company that has strong open source roots and was also, for a while, held up as a gold standard of the “land and expand” strategy among enterprise software companies. As this deep dive analysis on the acquisition suggests, business continuously got tougher since its 2021 IPO, net-dollar retention rate declined steadily, customer counts began to plateau, and AI has deprioritized multicloud deployment needs, when most companies are either using a single cloud or building AI in their own private cloud.

Software is not dead, because of AI. If anything, I firmly believe that generative AI will usher in an era where more software will be created to solve more problems with technology. Nor do I think that developers will be completely cut out from picking their own tools; earning the love of developers by building delightful products is still priority number 1 for any enterprise software companies.

However, the proliferation of bottoms-up “land and expand” is likely over, thanks to AI’s overwhelming strategic importance among corporate executives. Software companies who can quickly re-architect themselves to build top-down relationships, navigate among many CXO’s, and attract the a-dime-a-dozen top-notch enterprise sales talent will survive this temporary bump and thrive. For the ones that can’t, or won’t, it’s probably a better path to get acquired and hide within a larger outfit with those relationships built-in, like what Hashicorp chose to do.

I swipe my corporate card for chatgpt and claude chat bot every month, and use it in day to day basis. It boosts the work productivity. It's quite similar if I pay for slack