US vs China: A Cloud Proxy War

As diplomacy and cloud collide, regions to watch: Southeast Asia, Latin America, the Middle East.

The US-China tech “cold war” appears to have a new front: the cloud.

According to the New York Times, both the Departments of State and Commerce are looking into new ways to restrict Chinese cloud hyperscalers, e.g. AliCloud, Huawei Cloud, Tencent Cloud, etc. The justifications are the usual, if not oftentimes vague, dual threats of national security and stealing sensitive American data. If any new rules or restrictions were to be announced, they would seek to limit the growth and traction of these “Chinese clouds” both domestically in the US and around the world.

The domestic restrictions are predictable enough – just another straw of a multi-year regulatory squeeze to totally eliminate Chinese tech presence in America. Although AliCloud and Tencent Cloud still operate data centers on both the west and east coasts of the US, their traction and ambition have been dramatically downsized. Instead of competing with AWS or GCP head-to-head for large customers, they are limited to servicing non-sensitive SMEs and providing additional cloud capacity for Chinese customers seeking some expansion growth in the US. (And when this expansion growth reaches a certain scale, like TikTok with AliCloud, it is forced to switch to an American cloud vendor, like what ByteDance is doing with Oracle Cloud.)

However, who will win this new front outside of the US is far from certain and with a lot at stake. Based on some estimates, the current size of the global cloud computing market is $569 billion USD and is projected to grow to $2.4 trillion USD by 2030. That is a ton of CPU/GPU compute, data storage, and network bandwidth consumption up for grabs.

Thus, this global “cloud proxy war” between American clouds and Chinese clouds can evolve in interesting ways, especially in fast-growing, diplomatic bellwether regions where the geopolitical allegiances are anything but clear. I’ll highlight three of these regions today: Southeast Asia, Latin America, and the Middle East.

Three New “Battlefronts”

On some level, the competition in these three regions has been underway for a few years now. In some regions, the American clouds are ahead in their investments, while the Chinese clouds have more traction in other places. The battle is already fierce, and any new policy from the US government would elevate the competition to a new level.

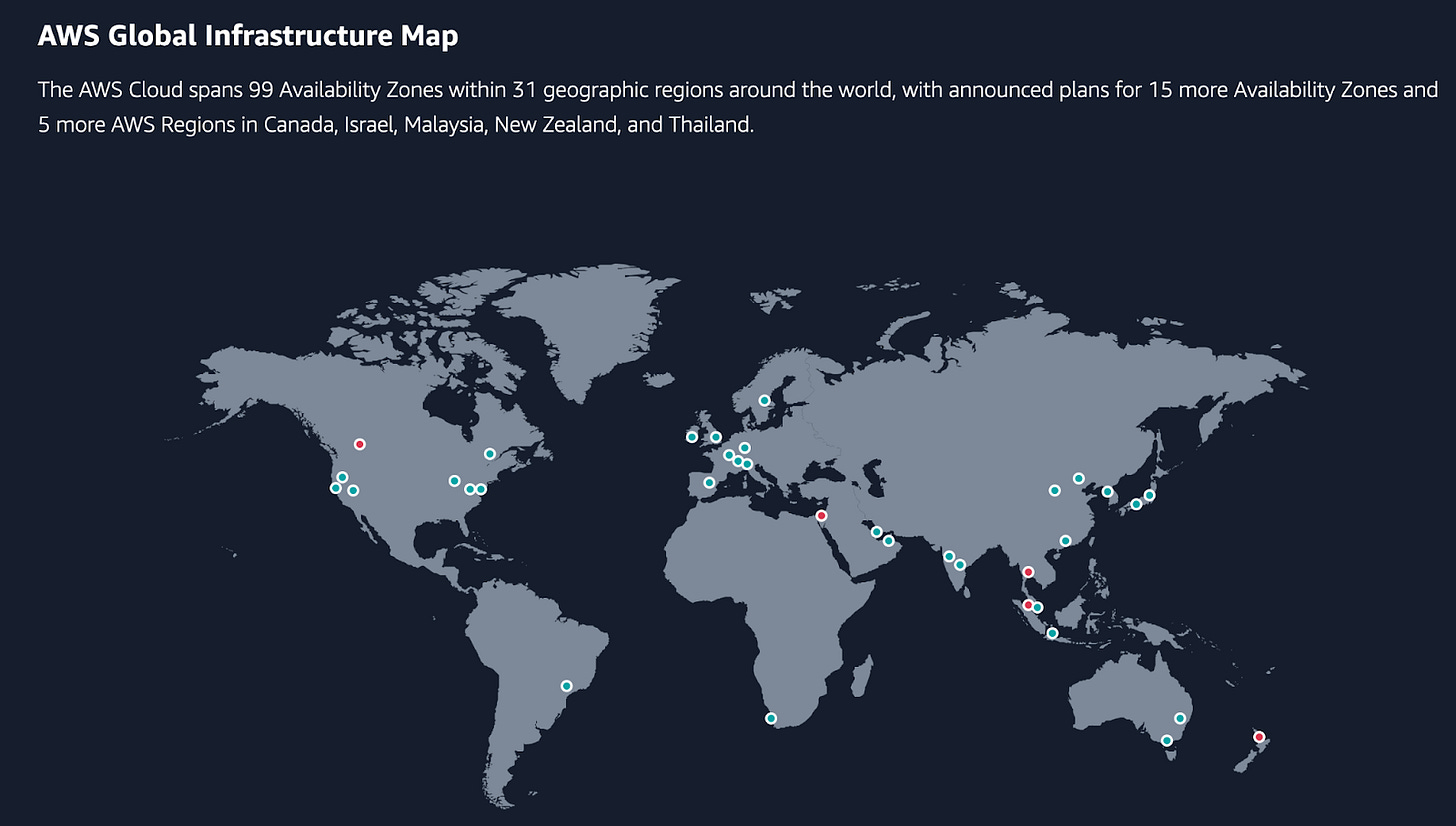

When I wrote “Where Can the Chinese Internet Go?” two years ago, I briefly profiled these three regions’ growth prospects for Alibaba and Tencent in particular. Even though the entire Internet sector in China is going through a massive slow down, the cloud data center expansions have continued apace. So one way to size up the two sides of this “cloud proxy war” is to look at the existing data center investment footprint, among the top three Chinese clouds (AliCloud, Tencent Cloud, Huawei Cloud) and the top three American clouds (AWS, Azure, GCP) in Southeast Asia, Latin America, and the Middle East.

Southeast Asia:

In the last three years, the Chinese clouds have all deepened their cloud data center footprint in Southeast Asia, particularly in Thailand, in addition to longstanding build outs in Singapore and Indonesia. (AliCloud has also added a data center in the Philippines.)

This progress outpaces their American counterparts. AWS has data centers in Singapore and Indonesia, but its Thailand and Malaysia locations are still being developed. Azure has a data center presence in Singapore, but its Indonesia and Malaysia locations are still labeled “coming soon”. GCP (Google Cloud Platform) has a solid data center presence in Singapore and Indonesia, but no publicly-known plans to expand further in this region.

It’s important to note that solely comparing the number of locations does not paint an accurate picture. Each location’s number of “availability zones” (or AZs) is also a useful factor to measure depth of investment. Without getting into too many cloud computing jargons, essentially the more availability zones a single location has, the more maturity, redundancy, and performance that location has. Here’s summary of each cloud’s Southeast Asian locations and their respective AZs count:

AWS: Singapore - 4; Indonesia - 3; Total - 7

Azure: Singapore - 3; Total - 3

GCP: Singapore - 3; Indonesia - 3; Total - 6

AliCloud: Singapore - 3; Indonesia - 3; Malaysia - 2; Philippines - 1; Thailand - 1; Total - 10

Tencent Cloud: Singapore - 4; Indonesia - 2; Thailand - 2; Total - 8

Huawei Cloud: Singapore - 4; Indonesia - 3; Thailand - 3; Total: 10

On an AZs-by-AZs basis, AliCloud and Huawei Cloud are in the lead in Southeast Asia each with 10, with AliCloud having more geographically diversity. AWS has the most from the American side with seven.

Latin America:

Latin America is a region where Chinese technology companies have been making inroads for many years, from e-commerce to ridesharing to electric vehicles. More recently, Chinese manufacturers of all kinds are setting up shop in different Latin American countries (Mexico, in particular) to produce products that can be more easily sold into the US that are mostly Chinese made, but with a light coating of “friendshoring” and “nearshoring” added.

On the cloud front, let’s do the same availability zones-based exercise on Latin America between the American clouds and their Chinese counterparts to see which has made the most in-region investments and inroads so far:

AWS: Brazil - 3; Total - 3

Azure: Brazil - 3; Total - 3

GCP: Brazil - 3; Chile - 3; Total - 6

AliCloud: None

Tencent Cloud: Brazil - 1; Total - 1

Huawei Cloud: Brazil - 2; Chile - 2; Peru - 2; Mexico - 2; Argentina - 1; Total: 9

Huawei is the leader here, with both the most AZ’s and geographical diversity, dramatically outpacing its Chinese and American competitors. GCP has the most among the American clouds with six.

In general, the cloud computing footprints are less built out in Latin America compared to Southeast Asia. This matches up with the two regions' overall difference in digitization and technology adoption. Latin America is about five to seven years behind Southeast Asia. This gap explains why Southeast Asian tech, like Shopee, is doing very well in Brazil, while Latin American-native tech companies look to Southeast Asia (and China to some extent) for lessons and inspirations. The two regions are much closer in their development cycle than compared to the U.S., so cross-regional lessons are more relevant and useful.

The Middle East:

Now, let’s do the same AZ-to-AZ comparison for the Middle Eastern region:

AWS: Bahrain - 4; UAE - 3; Total - 7

Azure: UAE - 3; Qatar - 3; Total - 6

GCP: Qatar - 3; Israel - 3; Total - 6

AliCloud: Saudi Arabia - 2; UAE - 1; Total - 3

Tencent Cloud: None

Huawei Cloud: Turkey - 3; Total - 3

Here the American clouds are clearly ahead, with more locations and more availability zones. The only noteworthy point from the Chinese clouds is Huawei being the only vendor with a data center presence in Turkey (Istanbul).

Zooming out, the Middle East has the least number of AZ’s compared to Southeast Asia and Latin America. This is likely due to both the relatively lack of digitization and tech penetration in the region and its physical proximity to Europe and India, both of which have more established data centers that can service the Middle Eastern region. With oil-infused sovereign wealth funds more aggressively investing in tech, the region may see more growth that would warrant additional data center investments soon. Mubadala, the Abu Dhabi sovereign wealth fund, is publicly going “on offense” as sources of capital become tight in western markets. Saudi Arabia’s Public Investment Fund, in a rare move of transparency in the capital allocator community, publicly disclosed its investments in many top technology funds, like a16z and Coatue.

The Middle East is a region that will become a prime battleground between the US and China, both technologically and diplomatically. The US is no doubt the incumbent and a long time diplomatic “resident” of the region with many ill-fated wars and ineffectual peace talks. Meanwhile, China, the diplomatic newcomer, notched an early win by brokering the restoration of relationships between Saudi Arabia and Iran.

Where Diplomacy and Cloud Collide

This impending global “cloud proxy war” (should it occur) feels reminiscent of the global 5G war, where the US government applied its diplomatic muscle forcefully to pressure countries not to use telecom equipment from Huawei and ZTE to build their domestic 5G networks. This pressure has worked to some degree in countries like Germany, France, the Netherlands, Japan, and India – all formal allies of the US, but has been less effective in other parts of the world. This is in large part due to no American tech alternatives – it’s hard to credibly pressure a country to not use something, when your own country’s technology is also behind.

US diplomats won’t have the same problem with cloud computing. By almost every measure and dimension, the top three American clouds are more advanced than the top three Chinese clouds. The only imaginable advantage the Chinese clouds may have is to play an extreme price war, buoyed by government subsidies, on mostly undifferentiated and commoditized cloud services, like object storage or containerized servers. It is a “war” the American side should win.

The three regions we highlighted – Southeast Asia, Latin America, the Middle East – are all “swing” regions, where their diplomatic alliances are less one-sided towards either the US or China. This bellwether status will likely continue in a strategic way, as these regions don’t want to fall under either camp and would prefer to be courted to maximize their own influence, independence, and get the best deals. These deals may very well come in the form of more data center investments to boost the pace of digitization or heavily-discounted cloud contracts with large local enterprises or governments – all of which make these three regions worth watching closely, as diplomacy and cloud collide.

As much as this “cloud proxy war” may be a contest that heavily favors the American clouds, the US government’s hostile attitude towards Big Tech adds an awkward wrinkle. While the State Department looks to enlist AWS, Azure, and GCP to push back against the Chinese clouds globally, the FTC is suing Amazon for dark patterns in Prime, attempting to block Microsoft’s acquisition of Activision Blizzard, while the Justice Department is suing Google for monopoly in digital advertising.

It’s hard to willingly do your government’s bidding abroad, when that same government is trying to break you up at home. And even if AWS, Azure, and GCP decide to “put country first” and set aside those petty, anticompetitive grievances, do you really want foreign service officers to do your presales?

If you like this post, some others you might like:

RESTRICT China

From time to time, I like to read the full text of a legislative bill, if only to put my past work experience at the White House and my law degree to some good use. What caught my attention recently was the RESTRICT Act, which goes after the national security implications of Chinese technologies in the US. It is getting lots of traction in DC, so I read…

How to Invest in China's Cloud

A couple of weeks ago, we published a detailed breakdown of China’s cloud industry’s current state of development, which resonated with many industry analysts and technologists. We combed through the official whitepaper published by the government-affiliated think tank, China Academy of Information and Communications Technology (CAICT), and combined our…

Kakao, Data Center Fire, the Data Residency Dilemma

I used to work at an open source distributed database startup called PingCAP. As the exec driving the company’s global market expansion effort, I talked to a lot of cloud architects and distributed systems engineers (as potential customers) about how a distributed database can be used for “disaster recovery”. It is a term used often by technical folks w…

An added dimension to national competition is anti-trust and market structure. GCP and Azure lag behind AWS as cloud providers in terms of quality and services, despite an incredible array of talent, due to bloated mismanagement and cushy profit margins from other revenue streams. Google is a particularly egregious example of a tech company that fundamentally can not build new products, in large part due to their monopoly on search buffering every other division (cloud, maps, youtube, etc) from needing to be competitive. Structuring markets to require more competition in this incumbent heavy space is tied to national competition with China.