Welcome to my first annual investment letter – a deep dive review of my performance from the previous year and some honest reflections, professional and personal, that may shine a light on what's ahead.

To new and old readers alike, a friendly reminder: at Interconnected, I run a long-only equity portfolio that is laser-focused on investing in the “picks and shovels” of the interconnected global digital AI economy. I draw on my technology business operator's experience and geopolitical antennas to bring an edge to how I assess a tech company’s rhythm and prospects in a constantly changing world.1

Although we are just getting started, Interconnected Capital has gotten a few nice press mentions lately – Wall Street Journal, Financial Times, South China Morning Post – where I shared my thoughts on a range of topics, from the geopolitical implications of US sanctions on AI chips to Alibaba’s current malaise.

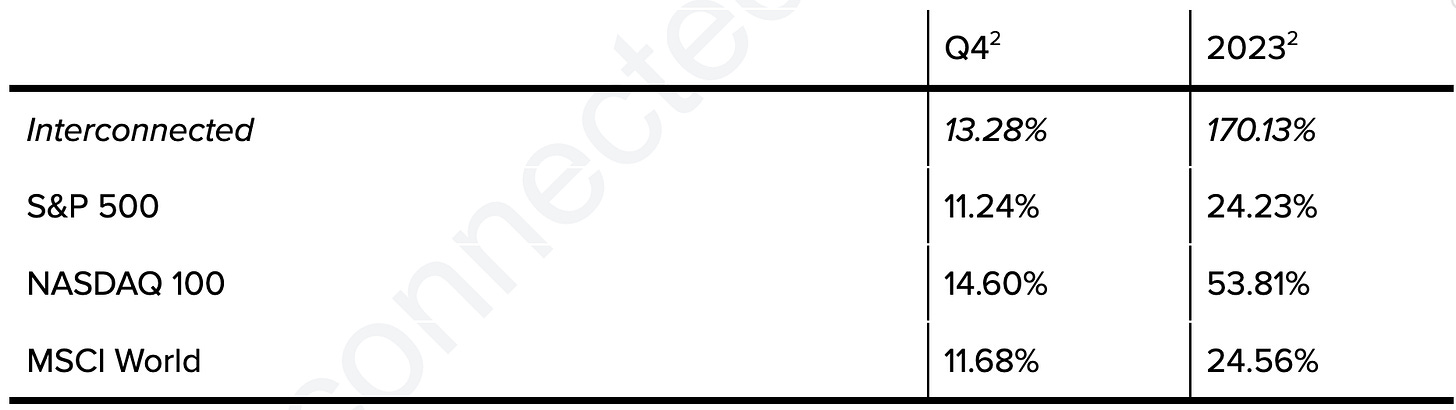

Of course, press quotes aren’t performance return. You can’t buy food and feed your family with them. So, more usefully, here is my Q4 2023 and cumulative 2023 performance, plus comparisons with three relevant benchmarks.

1 My past experiences include: senior leadership position at GitHub (the world’s largest developer and open source technology platform, now owned by Microsoft), a unicorn database startup, early stage VC, and the White House and Department of Commerce during the Obama administration. I studied law and computer science at Stanford; international relations at Brown.

2 Through December 31, 2023. Returns are net of an assumed management fee of 0.5% and performance fees of 15% calculated on a proforma basis. The 3rd-party auditor’s statement of investment performance statistics document is available upon request.

Top holdings in alphabetical order (as of December 31, 2023):