Will ChatGPT Make Baidu Relevant Again?

It's all about Cloud and self-driving, not Search.

Thank you for subscribing to Interconnected! Before we get into today’s post, a quick ask: as I mentioned in my Interconnected Annual Letter 2022, I’m looking to connect with and learn from more family offices, especially ones operating outside the US, on how they operate, what they care about, and how they see the world. If you happen to have connections to this type of family office (or indeed are part of one yourself), I would appreciate an introduction to arrange a 45-minute to 1-hour learning call over Zoom. Thank you!

ChatGPT has set off an AI arms race – and this arms race is global. Even though the seemingly ubiquitous chatbot is blocked in China, Baidu is set to release its own ChatGPT-like bot in March. Most of the reporting so far, in both English and Chinese business media, frame the announcement as a tactic to boost its core search business. This angle shows a glaring lack of understanding of the business value of a ChatGPT-like bot, and the years of technology progression that must be accumulated to make that business value real.

It’s true that Baidu is glomming on to the ChatGPT-induced frenzy to boost its relevance, just like Google with its $300 million investment into Anthropic (an OpenAI competitor) and every startup with cash left to pivot in Silicon Valley. However, Baidu has been an active participant in this so-called “AI arms race” for at least a decade. Its ChatGPT-like bot, named Ernie (or 文心 in Chinese) is an application derived from PaddlePaddle – a homegrown deep learning framework that began its development as early as 2013 and open sourced on GitHub in 2016. (PaddlePaddle is analogous to Google’s Tensorflow and Facebook’s PyTorch.)

So Ernie didn’t come from nowhere, nor is it a “copycat” knock-off of ChatGPT, like some lazy reporting suggested. If Ernie does catapult this otherwise anemic Chinese tech company to a new level of growth, Baidu more than deserves it. And this transformation would not come from Search, but two other smaller but more AI-natural product lines – Cloud (launched in 2013) and Apollo (self-driving project launched in 2016).

Search is “Dead”

Before we discuss the rationale behind why Ernie is geared to boost Baidu’s Cloud unit and Apollo project, let’s first understand why it is not meant to boost Search.

Search, as a user behavior, is effectively dead. Not “dead” as in no one will use a search engine. Of course not. But “dead” as in this behavior will no longer grow meaningfully, thus nor will Search as a product.

This massive user behavior change was ushered in by the other “B” in China Tech – ByteDance. The key insight that ByteDance productionized, first with Jinri Toutiao in 2012 (its news app), then with Douyin and TikTok in 2016, is that the act of “searching” is unnecessary when a recommendation engine can know, within seconds, what you want simply by showing you a few things first, collect some data, then quickly adjust to serve up what you are looking for. You no longer have to form a query about exactly what you are looking for anymore – the prerequisite for Search.

ByteDance, having first productionized and commercialized this “post-Search” user experience, has been eating Baidu’s lunch for years. Their relative market caps reflect this difference. As of today, Baidu’s market cap is roughly $50 billion USD, which includes the post-ChatGPT-bot announcement bump. ByteDance’s most recently reported market cap sits at $240 billion USD, which prices in the ever-present specter of TikTok getting banned in the US. Granted, ByteDance is a private company and its stocks are not trading publicly, so this comparison is not exactly apples-to-apples. Nevertheless, the post-Search company is worth at least 4-5x more than the Search company, because younger generations of Internet users simply don’t “search” anymore.

This does not mean incorporating Ernie, or other elements of PaddlePaddle, won’t improve Baidu’s search experience. I’m sure when Ernie debuts in March (or whenever Baidu decides to do it), it will spark a rush of usage, novelty, and attention to boost search revenue temporarily. Deep learning systems, as Google has shown over the years, also have shown to be able to improve search results (and digital ads targeting). I would be shocked if parts of PaddlePaddle are not in Baidu’s search engine already.

Sadly, these improvements in search won’t move the needle much for Baidu’s bottom line when search – a stable and shrinking market – is effectively “dead”.

Baidu AI Cloud

A more natural and higher-potential business for Ernie to make a real dent is Baidu’s cloud unit. Dubbed the “Baidu AI Cloud”, it has always sought to differentiate itself with AI, similar to Alphabet’s Google Cloud Platform’s market positioning.

The rationale is quite straightforward. We (Baidu) build an AI framework (PaddlePaddle) and applications (image generation, natural language processing, conversational bot like Ernie, etc.), and we make these technologies available as APIs on our cloud platform. Whether customers use our applications directly, or use our APIs to build their own AI applications, we charge them for consuming our cloud computing resources and make money either way.

This is the same logic that underpins Microsoft Azure’s symbiotic relationship with OpenAI – whether you use ChatGPT directly or use OpenAI APIs to make your own chatbot, Azure makes money either way. That’s why last month, riding on the buzz of ChatGPT, Microsoft announced that all of OpenAI’s latest and greatest APIs and frameworks – GPT-3.5, Codex, DALLE 2 – will be generally available for Azure customers. Baidu is fully aware of this playbook and has been executing along the same direction – various AI models labeled Ernie (or 文心) have been available as APIs on Baidu AI Cloud for quite some time (see screenshot below).

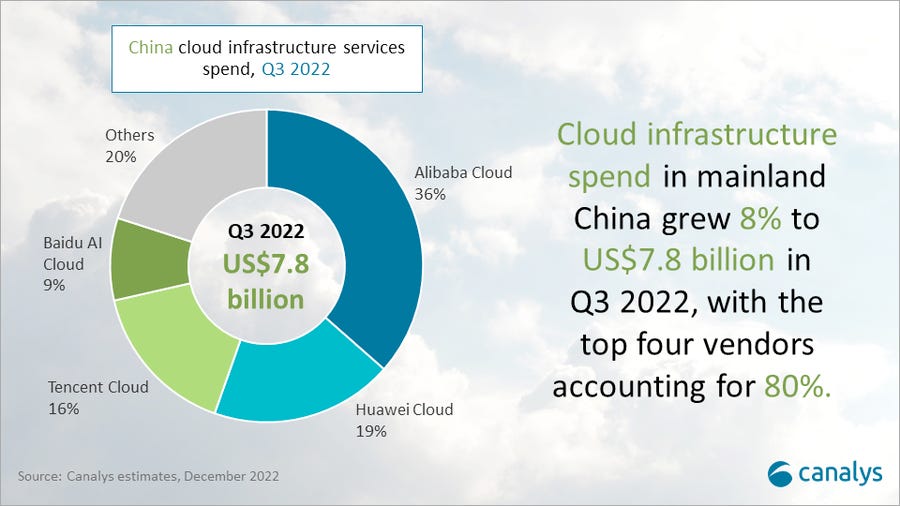

However, this playbook is easier said than done for Baidu. According to Canalys’s latest estimates of China’s cloud market, as of Q3 2022, Baidu’s market share is a mere 9%, trailing Alibaba, Huawei, and Tencent.

If you read last year’s cloud industry whitepaper published by the China Academy of Information and Communications Technology (CAICT) – a think tank affiliated with the Ministry of Industry and Information Technology – you will only see Baidu marginally mentioned in the PaaS category. (For interested readers, I wrote a deep dive on this whitepaper a few months ago.)

In short, Baidu AI Cloud is a laggard in China, which is already quite competitive with incumbents (AliCloud), state-owned telecoms (China Telecom’s CTyun), and new entrants (ByteDance Cloud) all vying for a piece of the same pie. This unfortunate position, of course, makes the release of Ernie all the more compelling.

If Ernie the chatbot takes off like ChatGPT, whether a company wants to use Ernie directly or build its own Ernie, the eventual big winner should be Baidu AI Cloud.

Self-Driving Apollo Robotaxis: Ernie-Style

The other high-potential unit that lends itself well to Ernie is Apollo, but the revenue relationship is more subtle and multi-dimensional.

For background, Apollo is Baidu’s self-driving software and hardware stack. It was launched and open sourced back in 2017. The ambition around Apollo is to become the operating system for other self-driving carmakers, as well as the technology powering Baidu’s own brand of robotaxis. Not surprisingly, there is already some overlap between the Apollo project and the PaddlePaddle project – the two teams have collaborated to build a 3D computer vision and detection system to enhance self-driving. Thus, integrating Ernie into Apollo should not be difficult.

I have discussed Apollo in previous posts as a leading open source project out of China that has global potential. Because of its permissive licensing scheme (Apache 2.0), Apollo has the prospect of becoming the “Android of self-driving” for many carmakers, with Tesla being the Apple/iOS corollary.

With Ernie, Apollo could become that much more attractive. Ironically, an Ernie-enabled Apollo is the one scenario where a search-oriented, conversation-based user behavior both makes sense and could continue to make sense for years to come. No matter how reliable self-driving becomes, at least for the foreseeable future, passengers will likely still prefer to keep their eyes on the road and be ready for emergencies or malfunctions, which lends itself better to asking questions (or voice search) to a chatbot, not staring and clicking on a screen.

Baidu’s Apollo robotaxis network has already started charging passengers for rides during the 2021 Winter Olympics at its Shougang Park test location in Beijing to prove out the business model. It has ambitions to roll out this service in 65 cities by 2025.

If Ernie makes Apollo more “sticky” with passengers, these robotaxis will directly generate more revenue from these passengers. If Ernie makes Apollo more attractive as an operating system to other carmakers, there will be more self-driving cars running on Apollo, which will indirectly funnel a good chunk of computation workloads to Baidu AI Cloud.

These are all big “if’s” right now, with Ernie as a centerpiece of this multi-dimensional maneuver to revive Baidu’s relevance. With a decade worth of AI technology accumulation in PaddlePaddle, another decade-old platform in its Cloud unit, and a growing ecosystem around Apollo, Baidu has all the supporting pieces and is as well-positioned as any company to capitalize on the “ChatGPT frenzy”.

Baidu earned this opportunity, but the outcome is far from certain.